It’s February 14th, 2026, and if you happen to be wandering through the Sudirman Central Business District in Jakarta today, the vibe is… well, it’s different. A few years back, this neighborhood was practically vibrating with that frantic, slightly desperate energy of “blitzscaling” and the high-stakes hunt for the next billion-dollar unicorn. These days? The air feels a bit more grounded. Maybe it’s even a little more cynical, but honestly, it’s a healthy kind of cynicism. It feels like we’ve finally moved past the giddy honeymoon phase of the tech boom and settled into that “working through the bills” stage of a long-term relationship. It’s not nearly as flashy as the early days, but man, it feels a lot more sustainable.

According to the latest insights from RISE by DailySocial, the Southeast Asian tech ecosystem has officially entered what everyone is calling its “Efficiency Era.” Now, let’s be real—this transition wasn’t exactly something people signed up for voluntarily, but it was definitely necessary. We all vividly remember the absolute chaos of 2023 and 2024. It was a blur of layoffs, frantic pivots toward profitability, and that desperate, late-night search for any business model that didn’t involve setting a mountain of VC cash on fire every single month. Looking back from the vantage point of early 2026, those brutal growing pains were probably the best thing that could have happened to us. We’ve finally stopped chasing “ghost users” and started chasing actual, cold-hard revenue. And isn’t that how it’s supposed to work anyway?

Honestly, it’s incredibly refreshing to see. We’re no longer sitting in coffee shops talking about how many millions of downloads some random app managed to buy; instead, we’re talking about LTV (Lifetime Value) and CAC (Customer Acquisition Cost) like they’re the lyrics to a favorite song. The era of buying growth with subsidies is dead and buried, and the era of earning growth through actual utility has finally arrived. It’s about time, don’t you think?

We Blew Past the $300 Billion Milestone, but the Reality Check was Brutal

For years, we all pointed toward the horizon and talked endlessly about the “massive potential” of this region. Well, the future showed up. A 2024 report from Google, Temasek, and Bain & Company famously projected that Southeast Asia’s digital economy would hit a staggering $300 billion in Gross Merchandise Value (GMV) by 2025. As we sit here in 2026, the data confirms we didn’t just hit that target—we blew right past it. But—and this is a big “but”—there’s a major caveat. The actual composition of that $300 billion looks absolutely nothing like what we expected five years ago. It’s a completely different animal.

Back in the day, we all assumed this growth would be driven by endless e-commerce subsidies and dirt-cheap ride-hailing services. We thought we’d just burn money until everyone was hooked. Instead, the real growth has come from high-margin digital services, B2B SaaS, and a massive, unexpected surge in the “silver economy”—older generations who have finally embraced digital wealth management and health tech. It turns out that when you stop handing out free vouchers like candy, the people who stick around are the ones who actually need your service. What a concept, right? It’s amazing what happens when you build something people actually want to pay for.

But let’s not sugarcoat it: this growth came at a heavy price. The “Great Filter” of 2025 was a bloodbath. We saw dozens of mid-tier startups quietly fold their tents or get swallowed up by the giants for pennies on the dollar. It was a brutal, unforgiving year for any founder who couldn’t show a clear, believable path to black ink. But for the survivors? They’ve emerged leaner, meaner, and far more sophisticated than they ever were during the boom. They aren’t just “Uber for X” anymore; they have become integrated infrastructure plays that are woven into the very fabric of how Southeast Asia functions on a daily basis.

“The romanticism of the ‘founder in a garage’ has been replaced by the pragmatism of the ‘operator in the boardroom.’ We aren’t building sandcastles anymore; we’re building the foundation of a digital nation.”

— An anonymous Jakarta-based Venture Partner, January 2026

AI Finally Stopped Being a Pitch Deck Buzzword and Started Actually Doing the Work

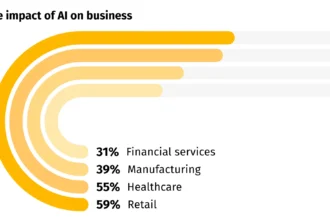

If 2023 was the year of “What is ChatGPT?” and 2024 was the year of “Let’s just slap a chatbot on it,” then 2025 was the year AI actually started doing the dishes. In the current landscape, if you’re running a tech company in Indonesia, Vietnam, or Thailand and you *don’t* have AI-driven logistics or automated credit scoring baked into your DNA, you’re basically a dinosaur. You just don’t know you’re extinct yet. The gap between the “AI-native” companies and the laggards has become a chasm that’s almost impossible to bridge.

According to a 2025 Statista report, AI integration among Southeast Asian SMEs rose by nearly 42% in just twelve months. And here’s the interesting part: this wasn’t because every small business owner suddenly became a world-class prompt engineer. It was because the tools themselves became invisible. Small shop owners in Bandung are now using AI-powered inventory management systems that tell them exactly what to buy before they even realize they’re running low on stock. To them, it’s not “high tech” or “AI”; it’s just the way they do business now. It’s as common as a calculator.

And we have to talk about the “Super App” evolution, because that whole scene has completely shifted. Remember when we thought Gojek and Grab would just keep adding more and more buttons to their home screens until the apps were 5GB in size and impossible to navigate? Thankfully, that era is over. The new “Super App” isn’t just a cluttered collection of icons; it’s a personalized AI layer. It knows your schedule, it understands your budget, and it remembers your preferences. It proactively handles the friction of your life before you even ask. It’s less of a Swiss Army Knife and more of a personal concierge. We’ve moved from the “search and click” model to the “anticipate and act” model, and honestly, it’s hard to imagine going back.

Why the “Personal OS” Model Ended Up Winning the War

Over the last year, we’ve seen a massive shift toward what many industry insiders are calling the “Personal OS.” Think about it: instead of you having to open an app to book a car, your digital assistant—which is likely integrated right into your favorite messaging app—simply pings you to say, “Your ride to the airport is outside, and I’ve already cleared your morning meetings because your flight is delayed by forty minutes.” That’s the dream, right? This level of deep integration is only possible because the data silos between fintech, logistics, and retail finally started to break down. Companies finally realized that hoarding data was actually less profitable than sharing it within a secure, AI-driven ecosystem. They stopped acting like rivals and started acting like components of a larger machine.

But, as with anything, there’s a flip side. This total reliance on AI has raised the stakes for data privacy and cybersecurity to an almost uncomfortable level. We’ve seen a few high-profile leaks in the region over the last year that served as a massive wake-up call; they made people realize just how much of their lives are now stored in the cloud. The “Trust Deficit” is the new biggest hurdle for any startup trying to break into the market. If you can’t prove, beyond a shadow of a doubt, that you’re a good steward of data, nobody cares how fast your delivery is or how sleek your UI looks. Trust is the new currency.

The Human Cost: Navigating the New, Slightly Terrifying Workforce

We really can’t talk about this whole tech evolution without acknowledging the elephant in the room: the jobs. The “Efficiency Era” has been a godsend for profit margins, but it’s been a total rollercoaster for the people actually doing the work. The mass layoffs we saw in 2024 weren’t just a temporary dip or a “correction”; they were a fundamental, structural realignment. A 2025 report from the World Economic Forum found that while “traditional” entry-level tech roles in the region declined by 15%, roles in data ethics, AI maintenance, and “human-centric” design spiked by 30%. The goalposts haven’t just moved; they’re in a different stadium now.

It’s a weird, stressful time to be a junior developer. You’re not just competing with other hungry grads for that entry-level spot; you’re competing with a GitHub Copilot that’s had three years of “experience” more than you and never needs to sleep. The advice we’re giving young people now isn’t just “learn to code”—that’s outdated. Now, it’s “learn to solve complex problems using the tools that do the coding for you.” The real value has shifted away from syntax and toward architecture, strategy, and empathy. It’s about knowing *what* to build, not just *how* to type it out.

And yet, there’s a beautiful, strange irony in all of this. As the tech becomes more automated and “perfect,” the “human” parts of the business have actually become more valuable. Customer service that actually involves a real person who can solve a complex, messy problem is now considered a luxury feature. Authentic storytelling in marketing is consistently outperforming the AI-generated fluff that’s flooding the internet. We’re seeing a return to “handcrafted” digital experiences. It’s like we’ve gone so far into the high-tech future that we’ve started deeply missing the human touch of the past. Go figure.

The Smart Money is Heading Out of the Capitals and Into the “Second Cities”

One of the most fascinating trends that RISE by DailySocial has been tracking is the total decentralization of the tech scene. For the longest time, if you weren’t physically located in Jakarta, Singapore, or Ho Chi Minh City, you basically didn’t exist in the eyes of investors. But the 2025 infrastructure push—specifically the rollout of low-latency satellite internet and much better 5G coverage in rural areas—has completely changed the game. Some of the most exciting fintech startups of the last year didn’t emerge from a trendy co-working space in Kuningan; they came from Solo, Yogyakarta, and Da Nang. And they are thriving.

These “Second City” startups have a completely different DNA than their big-city cousins. They don’t have the luxury of sitting around thinking about “disruption” in the abstract. They are busy solving hyper-local, real-world problems: better irrigation systems for farmers, direct-to-consumer supply chains for local artisans, and micro-insurance for seasonal workers who have been ignored for decades. These companies are often profitable from day one because, quite frankly, they have to be. They are the “cockroaches” of the ecosystem—hard to kill, incredibly resilient, and perfectly adapted to their specific environment. Honestly, if I were an investor today, I’d be spending a lot more time on domestic flights to smaller cities than hanging out in the lobbies of 5-star hotels in the capital. That’s where the real innovation is happening.

Is the “Unicorn” era officially dead and buried?

I wouldn’t say it’s dead, but the definition has certainly changed. We’re no longer impressed by a $1 billion valuation if it’s built on a shaky foundation of $2 billion in losses. The new “Unicorns” are the companies that reach that valuation through sustainable, organic growth and actual market dominance, rather than just hype and massive VC rounds. We want to see the math, not just the vision.

Which sector is the “sleeper hit” of 2026?

EdTech is having a massive, well-deserved second act. But forget the “video lectures” of the pandemic era—that’s old news. This is about personalized, AI-driven vocational training that helps people rapidly reskill for the AI economy. It’s less about traditional degrees and more about “micro-credentials” that actually lead directly to high-paying jobs. It’s education with a clear ROI.

Closing Thoughts: The Maturity We Probably Needed All Along

So, where does all of this leave us? As we celebrate another Valentine’s Day, it’s clear that the “love” for tech in Southeast Asia has finally matured. It’s no longer that head-over-heels, slightly irrational, and often blind infatuation we saw in the early 2020s. It’s a more stable, albeit much more demanding, partnership. We expect more from our founders. We expect more from our apps. And most importantly, we expect a lot more from the technology itself. We’re not just looking for “cool” anymore; we’re looking for “essential.”

The “Great Pivot” wasn’t just about saving money or pleasing shareholders; it was about finding an actual purpose. We’ve stopped trying to build “the next Facebook” for the region and started building the “first Southeast Asian Digital Backbone.” It might not make as many flashy headlines in the global tech press as a massive, nine-figure funding round once did, but it’s doing something much more important: it’s actually working for the people who live here. It’s solving problems that matter.

And maybe that’s the best Valentine’s gift the ecosystem could give us. A tech scene that doesn’t just promise some far-off future, but actually delivers a present we can live with and grow in. It’s been a long, often painful road to get here, and we’ve got plenty of scars to show for it. But standing here in 2026, looking at how far we’ve come, I wouldn’t trade this version of our tech world for the hyper-inflated 2021 version for anything. We’re finally building things that are meant to last. And honestly? That feels pretty good.

This article is sourced from various news outlets. Analysis and presentation represent our editorial perspective.